INTRADAY TRADING IS ALL ABOUT WAITING 80% OF TIME.

WHICH IS PSYCHOLOGY, THEN EXECUTE TRADES,WITH PROPER

SYSTEM

Guessing isn’t a strategy

Unrivaled Features of Intraday

WHAT IS INTRA DAY TRADING.

NIFTY 30 POINTS IS ACCURATE AS YOU CAN GET WITH ACCURACCY UP TO 95% WITRISK REWARD OF 1:2 TO 1:5 MIN TO MAX, ITS ONLY SYTEM THAT CAN GENARATE THIS KIND OF ACCURACCY , IN INTRADAY CURRENTLY ON NIFTY. POINTS MAY BE MINIMUM BUT ACCURACCY IS THE THING YOU NEED TO CONSIDER HERE AND RISK REWARD RATIO.

NO OTHER SYSTEM IS EVEN CLOSE THIS ACCURACCY.

Choose Our Products

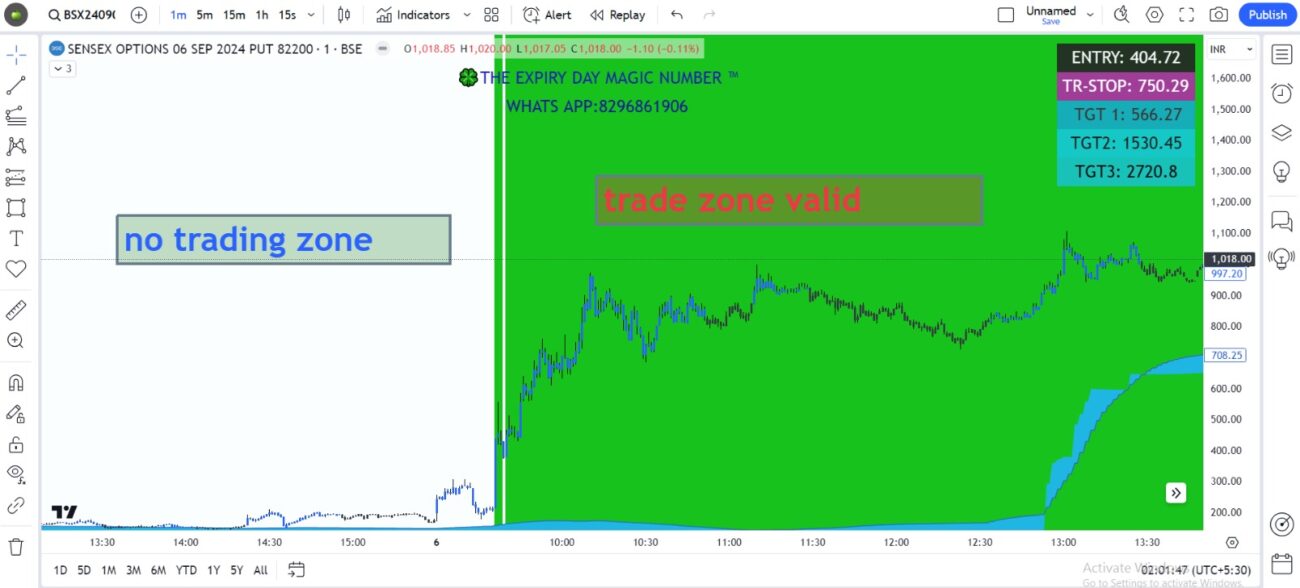

INDEX OPTIONS WITH NO SIDEWAYS TRADES

POSITIONAL OPTION’S TRADING SYSTEM FOR STOCKS & INDEX

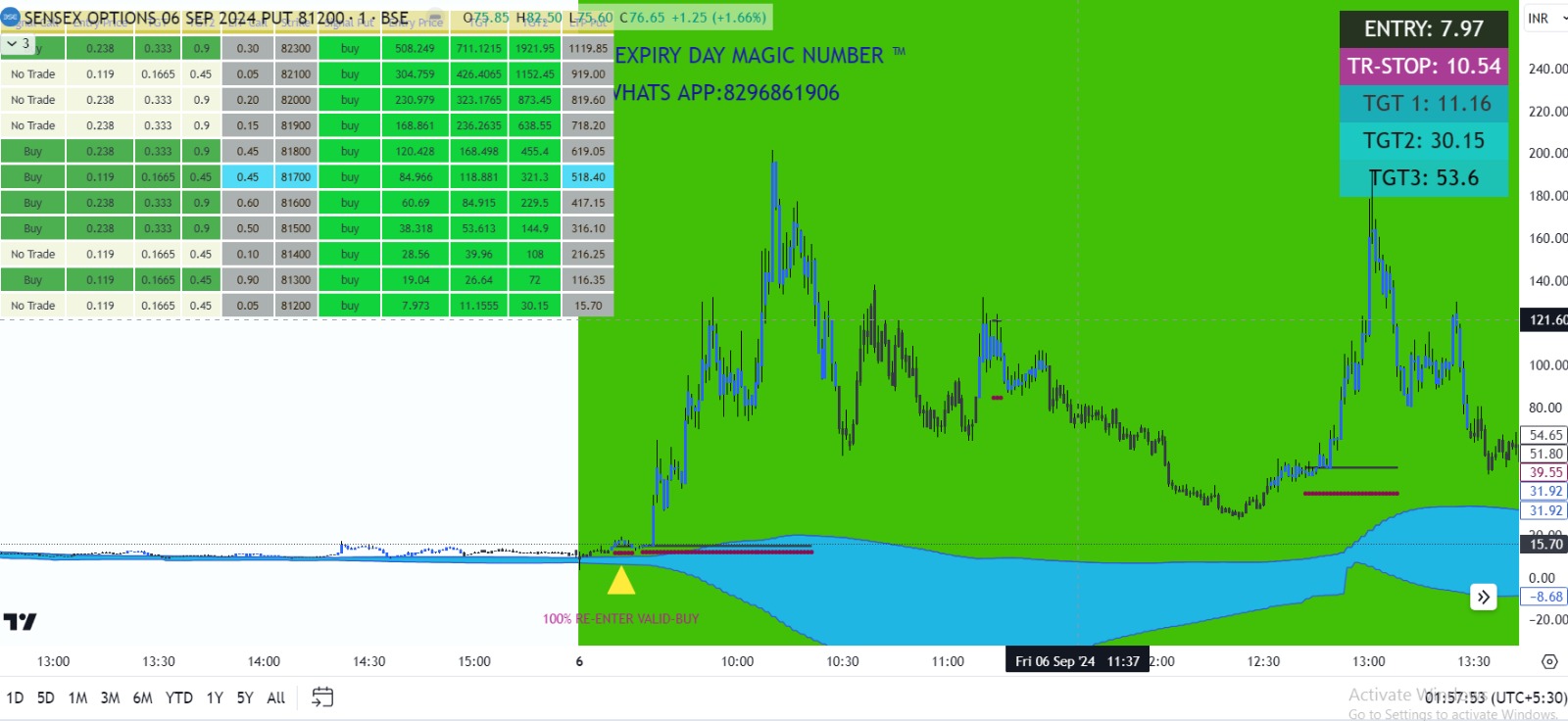

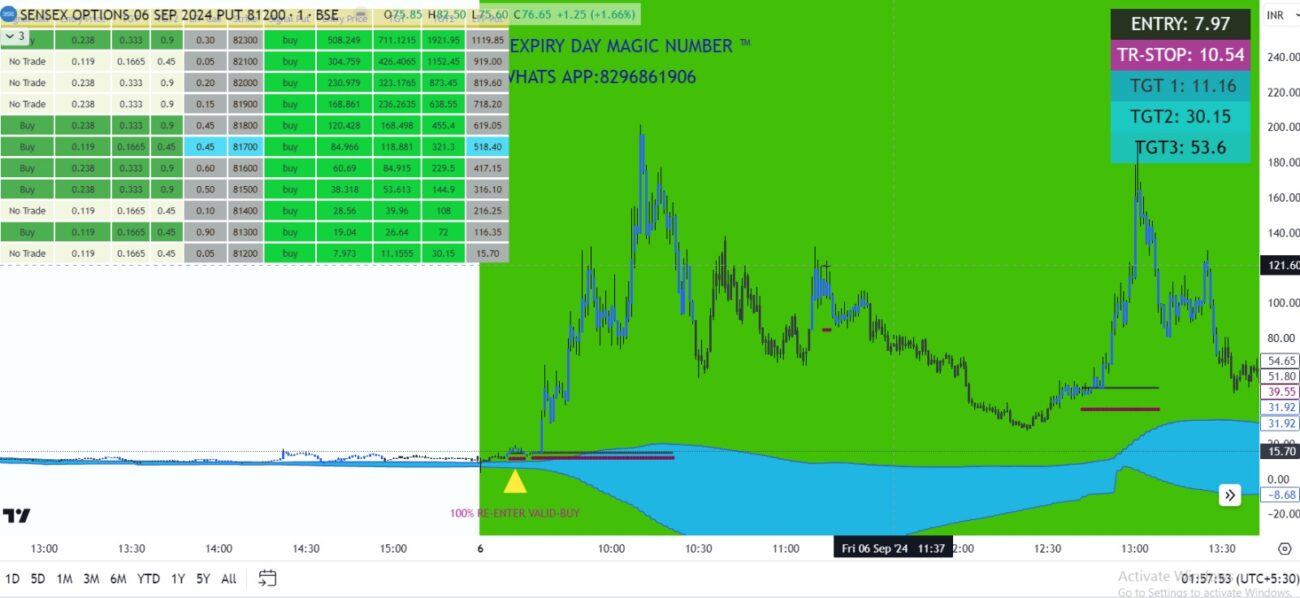

THE EXPIRY DAY MAGIC NUMBER

THE UNICORN VERSION OF OPTIONS TRADING

What Real Traders say,

Trading Technology Partners

Intraday are used by top performing traders

am a certified analyst, with 15+ years of market experience, and professional strategy

designer in financial markets from 2010,

VALUE OF KNOWLEDGE

With over 15 years of experience in the stock market, my trading journey has been a rollercoaster ride through some of the most significant market events in modern history. Since I began trading in 2005, I have witnessed five major market collapses and five remarkable bull runs, each leaving a lasting impact on my approach to trading and understanding of the financial markets.

Market Collapses and Bull Runs

Navigating through five market crashes taught me the importance of risk management, patience, and resilience. These downturns, while challenging, were also incredible learning opportunities. From the 2008 global financial crisis to more recent economic shocks, I learned that markets can be brutal, but they also offer chances for recovery and growth for those who stay disciplined.

On the other hand, the five bull runs I’ve experienced since 2005 reinforced the importance of identifying trends early, managing positions wisely, and not getting carried away by euphoria. A bull market is thrilling, but it's also a time when discipline is tested, as greed can easily cloud judgment. I’ve seen how staying grounded in both good times and bad can lead to long-term success.

Teaching and Mentorship

Over the years, I’ve been fortunate enough to share my knowledge and experience with over 1,649 students—and counting. Teaching others has been one of the most rewarding aspects of my trading journey. I’ve had the privilege of guiding aspiring traders, helping them develop the skills and mindset necessary to navigate the markets effectively. Whether it’s mastering technical analysis, understanding market psychology, or learning risk management, my goal has always been to equip my students with the tools they need to succeed.

Lessons Learned

One of the biggest lessons I’ve learned from my 15-year journey is that the market is constantly evolving. No two crashes or bull runs are exactly alike, and staying adaptable is critical. I’ve seen firsthand how strategies that work during a bull market can lead to significant losses during a downturn, and vice versa. That’s why I focus on continuous learning and adapting to new market conditions.

Through all the ups and downs, my belief in the power of education and preparation has only grown stronger. Trading is a marathon, not a sprint, and those who succeed are the ones who stay focused, disciplined, and open to learning from every experience the market has to offer.

Whether it's teaching students or trading my own portfolio, I am as passionate about the markets today as I was when I first started. The journey has been far from easy, but every bull run, crash, and student success story has made it all worthwhile. Here's to many more years of learning, growing, and sharing in the world of trading.

THEOPTIONS TRADING SYSTEM WITH LOW RISK

I HAVE UNDERSTOOD WHAT MAKES TRADERS FEEL COMFORTABLE IN INTRA DAY TRADING, HENCE I DESIGNED THIS OPTIONS TRADING SYSTEM FOR MY OWN TRADING, JUST FOLLOW THE GUIDELINES I PROVIDE AND SEE THE DIFFRENCE IN TRADING FROM DAY 1, THERE IS NO NEED TO WATCH, JUST TRADE THE RULES SYSTEM,ITS DESIGNED WITH COMPLEX ALGO CODE TO GET HIGHEST ACCURACCY,

FOLLOW RULES & SEE THE DIFFRENCE